Simplify Your Business Finances: Expert BAS & IAS Preparation and Lodgement

Reliable and accurate BAS and IAS services tailored for Australian businesses

Navigating the intricacies of Business Activity Statements (BAS) and Instalment Activity Statements (IAS) can be daunting for any small business owner. Ensuring compliance while managing day-to-day operations is a challenging balancing act. This is where Gold Coast small business accountants at Grow Advisory Group come into play, offering expert services that demystify the process and ensure accuracy.

Today, we’ll explore what BAS and IAS are, their importance for your business, and why choosing Grow Advisory Group for these vital accounting services can save you time, reduce stress, and keep your business compliant. Whether you’re registered for GST or need to report PAYG instalments, our accountants are here to support your financial needs.

What Are BAS and IAS?

Understanding your tax obligations can be challenging, but it’s crucial for the smooth operation of your business. Two critical components of business tax compliance in Australia are Business Activity Statements (BAS) and Instalment Activity Statements (IAS).

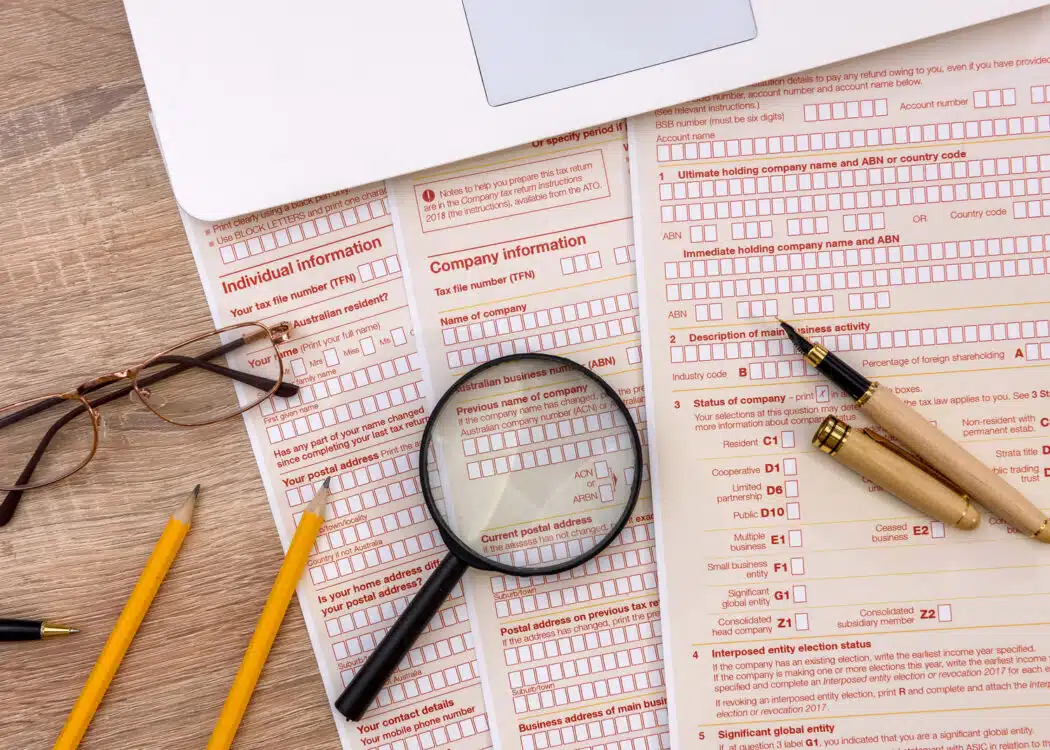

Business Activity Statements (BAS)

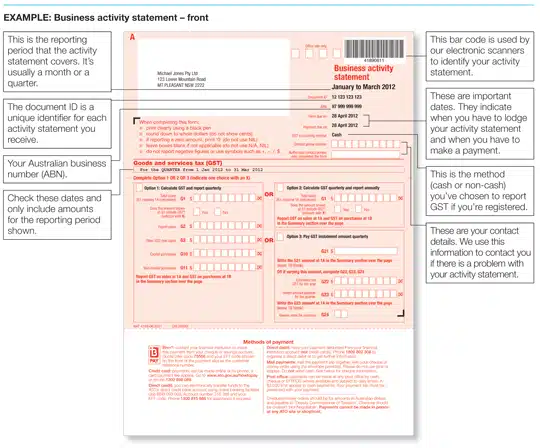

Business activity statement – front

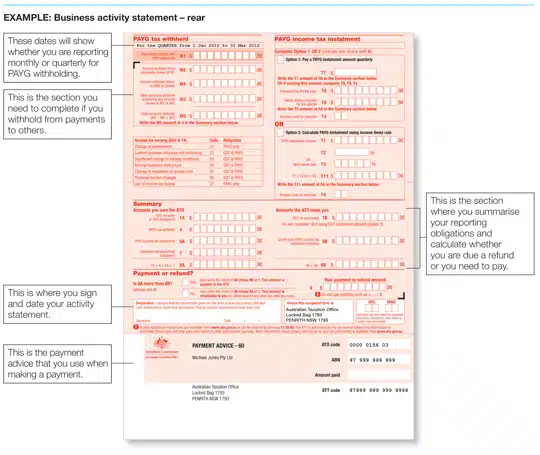

Business activity statement – rear

BAS is a form that businesses registered for Goods and Services Tax (GST) must lodge to the Australian Taxation Office (ATO). It reports and pays several tax obligations, including GST, Pay As You Go (PAYG) instalments, PAYG withholding, and other taxes. Timely and accurate BAS lodgement is essential to avoid penalties and ensure compliance with the ATO. Ensuring these lodgements are correct and on time helps keep your business running smoothly and avoids unnecessary fines.

Instalment Activity Statements (IAS)

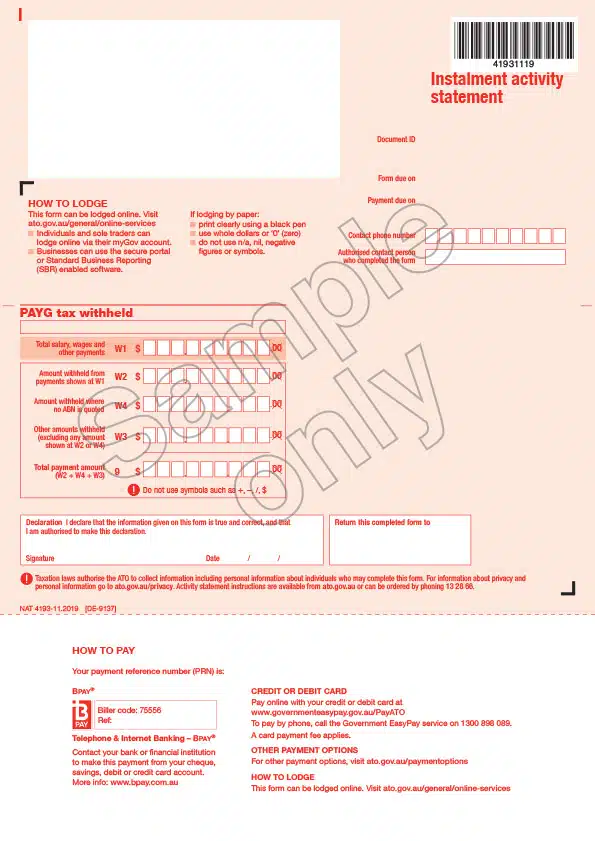

Unlike BAS, IAS is for businesses not registered for GST but still needing report PAYG instalments, PAYG withholding, or Fringe Benefits Tax (FBT) instalments. IAS keeps you compliant with your tax obligations, even if you don’t charge GST. Understanding the differences between BAS and IAS is crucial; while BAS covers a broader range of tax liabilities, IAS focuses on specific reporting needs for non-GST registered businesses.

These clear distinctions show why correctly managing BAS and IAS is vital for maintaining your business’s financial health.

Instalment activity statement – front Instalment activity statement – rear

Why Choose Grow Advisory Group for BAS & IAS Services?

Choosing the right accountant to manage your BAS and IAS responsibilities is crucial to maintaining your business’s financial health. At Grow Advisory Group, we combine expertise, accuracy, and efficiency to deliver unparalleled service.

Expertise and Experience

Our team has years of experience handling BAS and IAS for businesses across various industries, including retail, hospitality, healthcare, pharmacy and more. We pride ourselves on our professional qualifications and deep understanding of tax laws.

Qualifications and Experience:

- Certified Practicing Accountants (CPAs)

- Chartered Accountants (CAs)

- Extensive industry-specific knowledge

- Decades of combined experience in all facets of tax and accounting

Accuracy and Compliance

We meticulously ensure that all lodgements are accurate and compliant with ATO regulations. Our team stays abreast of the latest tax laws and regulations, providing the best accounting service possible.

Our stringent processes include multiple checks and balances to guarantee precision in every submission, safeguarding your business from potential penalties and ensuring compliance.

Time-Saving and Efficiency

Outsourcing your BAS and IAS preparation to Grow Advisory Group saves you valuable time, allowing you to concentrate on running your core business activities. (Click here to read our post on the benefits of outsourcing bookkeeping.)

We utilise advanced accounting software and efficient processes to streamline tasks, ensuring timely and precise lodgements. Proudly, we are also in Xero’s top 2% of accounting practices.

Our commitment to leveraging technology enhances efficiency and minimises errors, providing you with peace of mind and freeing up your time to focus on growing your business.

Our BAS & IAS Services

At Grow Advisory Group, we offer a comprehensive range of BAS and IAS services tailored to meet the specific needs of small businesses in Gold Coast and Tweed Heads. Our services are designed to ensure compliance, accuracy, and efficiency, allowing you to focus on growing your business.

Preparation and Lodgement

We provide end-to-end BAS and IAS preparation and lodgement services. Our small business accountants gather all necessary financial information, prepare the statements, and ensure they are lodged with the ATO on time. This step-by-step process includes reviewing your financial data, preparing accurate statements, and submitting them, ensuring you meet all compliance requirements without the hassle.

Review and Amendments

Our review services are designed to check for errors or discrepancies in previous BAS and IAS submissions. If any issues are found, we assist in making the necessary amendments to rectify them. This process involves thoroughly examining your past statements, identifying potential errors, and promptly addressing them to maintain compliance and avoid penalties.

Advice and Support

Beyond preparation and lodgement, we offer ongoing support and advice to help you manage your tax obligations effectively. Our team provides strategic tax planning to optimise your financial outcomes and offers continuous tax advisory services to keep you informed and compliant. Whether you need help understanding your tax position or planning for the future, our experts are here to guide you through every step.

By choosing Grow Advisory Group, you’re partnering with professionals dedicated to simplifying your business finances and ensuring your tax affairs are handled with the utmost care and precision.

Streamline Your Business Finances Today with Expert Guidance!

Ready to simplify your business finances? At Grow Advisory Group, we are committed to providing expert BAS and IAS services that will keep your business compliant and efficient. Our team of highly qualified accountants is here to guide you through every step of the process, ensuring accuracy and peace of mind. Contact us today for a free consultation and discover how our tailored solutions can help your small business thrive.

Visit one of our convenient locations or give us a call to get started:

Nerang Office:

10 New Street, Nerang, QLD 4211

Phone: 07 5502 1388

Varsity Lakes Office:

2-23 Main Street Varsity Lakes, QLD 4227

Phone: 07 5502 1388

Tweed Heads Office:

Suite 31, 75-77 Wharf Street, Tweed Heads, NSW 2485

Phone: 07 5599 5700

Let us help you take control of your business finances and achieve your financial goals.

Frequently Asked Questions

What is the IAS tax in Australia?

The Instalment Activity Statement (IAS) is a form used by Australian businesses that are not registered for Goods and Services Tax (GST) to report and pay their Pay As You Go (PAYG) instalments, PAYG withholding, and Fringe Benefits Tax (FBT) instalments. It helps ensure businesses meet their tax obligations even if they do not charge GST.

What does IAS mean in accounting?

In accounting, IAS stands for Instalment Activity Statement. It is used by businesses not registered for GST to report specific tax obligations like PAYG instalments, PAYG withholding, and FBT instalments to the Australian Taxation Office (ATO).

Can a BAS agent prepare an IAS?

Yes, a BAS agent can prepare and lodge an IAS. BAS agents are qualified professionals authorised to assist businesses with their BAS and IAS lodgements to ensure accuracy and compliance with ATO regulations.

Can I prepare BAS myself?

Yes, you can prepare and lodge your Business Activity Statement (BAS) yourself. However, it requires a thorough understanding of tax laws and accurate record-keeping. Many small business owners choose to engage a professional accountant or BAS agent to ensure accuracy and compliance, saving time and reducing stress.

What is a BAS in Australia?

A Business Activity Statement (BAS) is a form submitted to the Australian Taxation Office (ATO) by businesses registered for GST. It reports and pays several tax obligations, including GST, PAYG instalments, PAYG withholding, and other taxes. Lodging BAS accurately and on time is crucial to avoid penalties and ensure compliance.

What is the BAS used for?

The BAS is used for reporting and paying various tax obligations, including Goods and Services Tax (GST), Pay As You Go (PAYG) instalments, PAYG withholding, and other taxes. It helps the ATO track and manage tax collections from businesses.

Are BAS and activity statement the same?

Yes, the term “activity statement” generally refers to both BAS and IAS forms. These statements are used to report different types of tax obligations to the ATO, depending on whether the business is registered for GST.

What is the difference between BAS and IAS?

The main difference between BAS and IAS lies in the type of businesses using them and the tax obligations they report. BAS is used by businesses registered for GST and covers GST, PAYG instalments, PAYG withholding, and other taxes. On the other hand, IAS is for businesses not registered for GST and focuses on reporting PAYG instalments, PAYG withholding, and FBT instalments.

Why did I get an instalment activity statement?

You received an instalment activity statement (IAS) because your business needs to report certain tax obligations to the ATO, such as PAYG instalments, PAYG withholding, or FBT instalments, but is not registered for GST. The IAS ensures you remain compliant with your tax reporting requirements.

How much does it cost to complete BAS?

The cost of completing a BAS can vary depending on the complexity of your business’s financial activities and whether you choose to prepare it yourself or hire a professional. Hiring a BAS agent or accountant can range from $200 to $600 per statement, but costs may vary based on the type of business, level of service and expertise provided.

Contact Us Today!

Disclaimer: The information contained in this blog is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from an accountant and/or financial adviser.